Cox-Ross-Rubinstein (Binomial) Option Pricing Model: A Detailed Guide for You

Understanding financial models is crucial for anyone involved in the stock market or options trading. One such model that has gained significant popularity is the Cox-Ross-Rubinstein (Binomial) model. This article aims to provide you with a comprehensive understanding of the Cox-Ross-Rubinstein model, its assumptions, applications, and limitations. Let’s dive in.

What is the Cox-Ross-Rubinstein Model?

The Cox-Ross-Rubinstein (Binomial) model is a discrete-time, finite-state space model used to price American and European options. It was developed by John C. Cox, Stephen Ross, and Mark Rubinstein in 1979. The model is based on the assumption that the underlying asset’s price follows a binomial distribution over time.

Assumptions of the Cox-Ross-Rubinstein Model

Before we delve into the details of the model, it’s essential to understand its underlying assumptions:

| Assumption | Description |

|---|---|

| Binomial Distribution | The underlying asset’s price follows a binomial distribution over time. |

| Constant Risk-Free Interest Rate | The risk-free interest rate remains constant over the option’s life. |

| Constant Dividend Yield | The dividend yield remains constant over the option’s life. |

| No Arbitrage Opportunities | No risk-free profit opportunities exist in the market. |

How Does the Cox-Ross-Rubinstein Model Work?

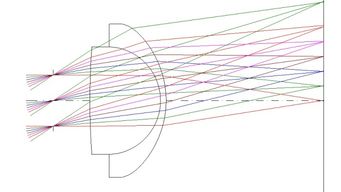

The Cox-Ross-Rubinstein model works by dividing the time to expiration into a series of discrete time intervals. At each time interval, the underlying asset’s price can either increase or decrease by a certain factor. The model then calculates the option’s value at each time interval and discounts it back to the present value using the risk-free interest rate.

Here’s a step-by-step breakdown of the model:

- Divide the time to expiration into a series of discrete time intervals.

- Calculate the up and down factors for the underlying asset’s price at each time interval.

- Generate a binomial tree of possible asset prices at each time interval.

- Calculate the option’s value at each node of the binomial tree.

- Discount the option’s value back to the present value using the risk-free interest rate.

Applications of the Cox-Ross-Rubinstein Model

The Cox-Ross-Rubinstein model has several applications in the financial industry:

- Pricing American and European options

- Valuing exotic options

- Comparing option prices across different models

- Assessing the risk of options portfolios

Limitations of the Cox-Ross-Rubinstein Model

While the Cox-Ross-Rubinstein model is a powerful tool for option pricing, it has some limitations:

- Discretization Error: The model assumes a discrete-time framework, which may not accurately reflect the continuous nature of the underlying asset’s price.

- Binomial Tree Size: As the number of time intervals increases, the size of the binomial tree grows exponentially, making the model computationally intensive.

- Volatility Assumption: The model assumes constant volatility, which may not hold true in the real world.

Conclusion

The Cox-Ross-Rubinstein (Binomial) model is a valuable tool for option pricing and has been widely used in the financial industry. By understanding its assumptions, applications, and limitations, you can make more informed decisions when trading options. Remember, the key to success in options trading lies in understanding the underlying principles and continuously learning from your experiences.