Invoicing and Accounts Receivable: A Comprehensive Guide

Managing invoices and accounts receivable is a crucial aspect of any business’s financial operations. It ensures that your company receives timely payments from clients and maintains a healthy cash flow. In this detailed guide, we will explore various dimensions of invoicing and accounts receivable, helping you understand the process, best practices, and tools available to streamline your operations.

Understanding Invoicing

Invoicing is the process of sending a detailed bill to a client for goods or services provided. It serves as a formal request for payment and provides a record of the transaction. Here are some key aspects of invoicing:

- Invoice Format: An invoice should include your company’s logo, contact information, client details, itemized list of services or products, quantities, prices, taxes, and total amount due.

- Invoice Number: Assign a unique number to each invoice for easy tracking and reference.

- Due Date: Clearly state the payment due date to encourage timely payments.

- Payment Terms: Specify the payment methods and terms, such as net 30, net 60, or net 90.

Best Practices for Invoicing

Following best practices for invoicing can help improve your cash flow and client relationships. Here are some tips:

- Consistency: Use a standardized invoice format for all transactions to ensure clarity and professionalism.

- Accuracy: Double-check the invoice for errors, such as incorrect prices, quantities, or client details.

- Timeliness: Send invoices promptly after completing the work or delivering the product.

- Follow-Up: Send reminders to clients who have not paid their invoices on time.

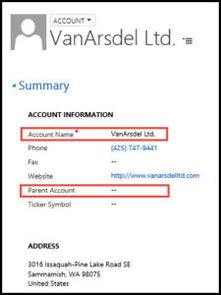

Understanding Accounts Receivable

Accounts receivable (AR) refers to the money owed to your company by clients. It is an essential component of your company’s financial health. Here’s what you need to know about AR:

- AR Aging Report: This report provides a breakdown of outstanding invoices, categorized by due dates, such as current, 30 days past due, 60 days past due, and so on.

- Collection Efforts: Implement a system for following up on late payments, including phone calls, emails, and letters.

- Debt Recovery: Consider hiring a collection agency if necessary to recover outstanding debts.

Best Practices for Managing Accounts Receivable

Effective management of accounts receivable can significantly impact your company’s financial stability. Here are some best practices:

- Regular Monitoring: Regularly review your AR aging report to identify and address late payments promptly.

- Clear Communication: Maintain open and transparent communication with clients regarding payment terms and due dates.

- Offer Multiple Payment Methods: Provide various payment options, such as credit cards, PayPal, and bank transfers, to make it convenient for clients to pay.

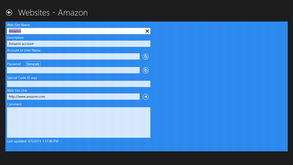

- Automate Invoicing and AR: Use accounting software to automate invoicing and AR management, reducing errors and saving time.

Tools for Invoicing and Accounts Receivable

Several tools can help streamline the invoicing and accounts receivable process. Here are some popular options: