Garland County Tax Collector AR: A Comprehensive Guide

Are you a resident of Garland County, Arkansas, or someone looking to understand the tax collection process in the area? Look no further. This article delves into the details of the Garland County Tax Collector in Arkansas, providing you with a comprehensive guide to their services, responsibilities, and how to interact with them effectively.

About the Garland County Tax Collector

The Garland County Tax Collector is an essential government entity responsible for collecting various taxes and fees within the county. This includes property taxes, motor vehicle taxes, and other local taxes. The tax collector ensures that these revenues are collected on time and distributed appropriately to fund county services and programs.

Services Offered by the Garland County Tax Collector

The Garland County Tax Collector offers a range of services to residents and businesses within the county. Here’s a breakdown of some of the key services:

-

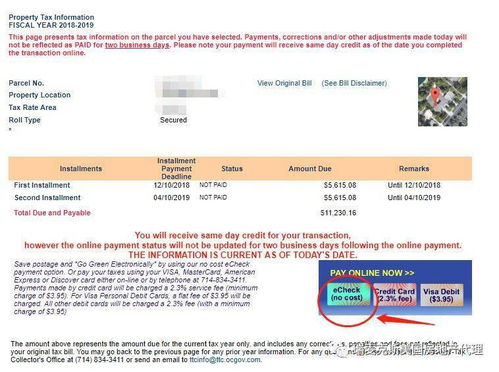

Property Tax Collection: The tax collector is responsible for collecting property taxes from homeowners and businesses. This includes the assessment of property values, calculation of taxes, and collection of payments.

-

Motor Vehicle Tax Collection: The tax collector also handles the collection of motor vehicle taxes. This involves registering vehicles, assessing taxes based on the vehicle’s value, and collecting payments.

-

Business Tax Collection: The tax collector collects business taxes from local businesses, ensuring that they pay their fair share of taxes to support county services.

-

Delinquent Tax Collection: The tax collector works to collect delinquent taxes, including those that have not been paid on time. This helps maintain the financial stability of the county.

Responsibilities of the Garland County Tax Collector

The Garland County Tax Collector has several responsibilities to ensure the smooth operation of tax collection within the county. These include:

-

Assessing Property Values: The tax collector is responsible for assessing the value of properties within the county to determine the appropriate tax amount.

-

Calculating Taxes: Based on the assessed property values, the tax collector calculates the taxes owed by homeowners and businesses.

-

Collecting Payments: The tax collector ensures that payments are collected on time and accurately recorded.

-

Reporting and Distribution: The tax collector reports collected revenues to the county government and ensures that the funds are distributed appropriately to support county services.

-

Enforcing Tax Laws: The tax collector works to enforce tax laws and regulations, ensuring compliance and addressing any violations.

How to Interact with the Garland County Tax Collector

Interacting with the Garland County Tax Collector is essential for residents and businesses to fulfill their tax obligations. Here are some tips on how to effectively interact with the tax collector:

-

Visit the Office: You can visit the Garland County Tax Collector’s office in person to inquire about your tax obligations, make payments, or request assistance.

-

Call the Office: If visiting the office is not convenient, you can call the tax collector’s office to speak with a representative. They can provide information, answer questions, and guide you through the process.

-

Online Services: The tax collector’s office may offer online services, allowing you to pay taxes, check your account status, and access important information from the comfort of your home.

-

Request Assistance: If you are facing difficulties in understanding your tax obligations or making payments, don’t hesitate to request assistance from the tax collector’s office.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions about the Garland County Tax Collector: