Understanding AP AR Reclassification in SAP: A Detailed Guide for You

As a business professional, you’ve likely encountered the term “AP AR Reclassification” in SAP. But what exactly does it mean, and why is it important? In this article, we’ll delve into the details of AP AR Reclassification in SAP, providing you with a comprehensive understanding of its significance, processes, and best practices.

What is AP AR Reclassification?

AP AR Reclassification refers to the process of reclassifying accounts payable (AP) and accounts receivable (AR) transactions in SAP. This process is essential for maintaining accurate financial records and ensuring compliance with accounting standards. By reclassifying transactions, you can correct errors, adjust account balances, and reflect the true financial position of your organization.

Why is AP AR Reclassification Important?

There are several reasons why AP AR Reclassification is crucial for your business:

-

Accuracy: Reclassifying transactions ensures that your financial records are accurate, which is essential for making informed decisions.

-

Compliance: Properly reclassifying transactions helps your organization comply with accounting standards and regulations.

-

Efficiency: Streamlining the reclassification process can save time and resources, allowing your team to focus on other critical tasks.

-

Transparency: Accurate financial records promote transparency and build trust with stakeholders, including investors, creditors, and regulatory bodies.

Understanding the Process

Now that we’ve established the importance of AP AR Reclassification, let’s take a closer look at the process itself.

Identifying Transactions for Reclassification

The first step in the process is to identify transactions that require reclassification. This can be done through various methods, such as reviewing financial reports, conducting audits, or using automated tools to flag potential discrepancies.

Reviewing and Analyzing Transactions

Once you’ve identified the transactions, it’s essential to review and analyze them to determine the appropriate reclassification. This may involve examining supporting documentation, such as invoices, receipts, and contracts, to ensure that the reclassification is accurate and compliant with accounting standards.

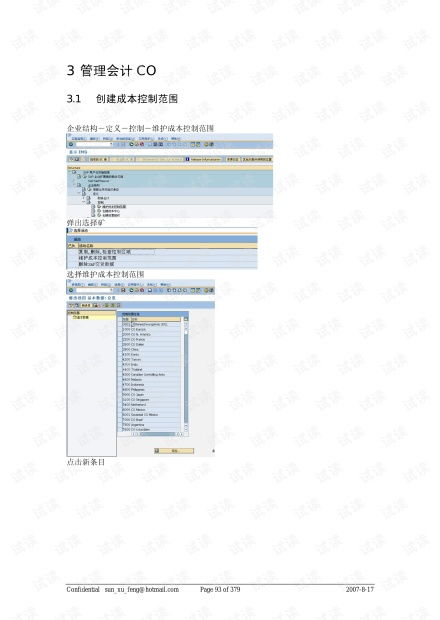

Entering Reclassification in SAP

After reviewing and analyzing the transactions, you’ll need to enter the reclassification in SAP. This can be done using the “Account Assignment” feature, which allows you to adjust the account assignments for the affected transactions.

Verifying and Approving Reclassification

Once the reclassification is entered, it’s crucial to verify and approve the changes. This ensures that the reclassification is accurate and reflects the true financial position of your organization. Verification can be done through various methods, such as comparing the reclassified transactions with supporting documentation or using automated tools to validate the changes.

Best Practices for AP AR Reclassification in SAP

Following best practices can help streamline the AP AR Reclassification process and ensure accuracy and compliance:

-

Establish clear policies and procedures for reclassification, including guidelines for identifying, reviewing, and entering transactions.

-

Train your team on the reclassification process and best practices to ensure consistency and accuracy.

-

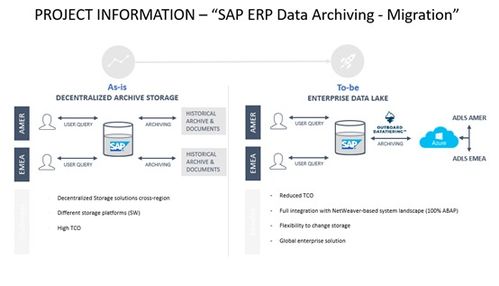

Utilize automated tools and reports to identify potential reclassification needs and monitor the process.

-

Regularly review and audit the reclassification process to identify areas for improvement and ensure compliance with accounting standards.

Common Challenges and Solutions

While AP AR Reclassification is an essential process, it can also present challenges. Here are some common challenges and their solutions:

Challenge 1: Identifying Transactions for Reclassification

Solution: Implement automated tools to flag potential reclassification needs based on predefined criteria, such as account balances, transaction dates, or vendor information.

Challenge 2: Ensuring Accuracy and Compliance

Solution: Establish a review process that includes multiple levels of verification, such as having a second party review the reclassification before final approval.

Challenge 3: Streamlining the Process

Solution: Utilize SAP’s built-in features and best practices to streamline the reclassification process, such as using the “Account Assignment” feature and establishing clear policies and procedures.

Conclusion