Understanding Trade Receivable: A Comprehensive Guide

Trade receivables, often referred to as accounts receivable, are a crucial aspect of a company’s financial health. They represent the amounts owed to a business by its customers for goods or services provided on credit. In this detailed guide, we will delve into the various dimensions of trade receivables, including their importance, management, and impact on a company’s financial statements.

What are Trade Receivables?

Trade receivables are a current asset on a company’s balance sheet. They arise when a business sells goods or services on credit, meaning the payment is expected to be received at a later date. These receivables are typically recorded as a separate line item on the balance sheet and are categorized as either short-term or long-term, depending on the expected collection period.

Importance of Trade Receivables

Trade receivables play a vital role in a company’s financial management. They provide a measure of liquidity and can be used to assess the company’s ability to meet its short-term obligations. Here are some key reasons why trade receivables are important:

-

liquidity: Trade receivables can be converted into cash relatively quickly, making them a valuable source of liquidity for a business.

-

cash flow management: Effective management of trade receivables can help a company maintain a healthy cash flow, which is essential for day-to-day operations.

-

credit risk assessment: By analyzing the aging of trade receivables, a company can identify potential credit risks and take appropriate actions to mitigate them.

-

financial performance evaluation: Trade receivables are a key component of a company’s financial statements and can be used to evaluate its financial performance over time.

Managing Trade Receivables

Managing trade receivables effectively is crucial for maintaining a healthy financial position. Here are some best practices for managing trade receivables:

-

credit policies: Establish clear credit policies that outline the terms and conditions for granting credit to customers, including credit limits and payment terms.

-

credit assessment: Conduct thorough credit assessments on new customers to ensure they have a good credit history and are likely to pay on time.

-

aging of receivables: Regularly review the aging of trade receivables to identify late payments and take appropriate actions, such as sending reminders or pursuing collections.

-

collections process: Develop a systematic collections process that includes follow-up on late payments and, if necessary, legal action.

-

financial reporting: Ensure that trade receivables are accurately recorded and reported in the financial statements.

Impact on Financial Statements

Trade receivables have a significant impact on a company’s financial statements. Here’s how they are reflected in the key financial statements:

Balance Sheet

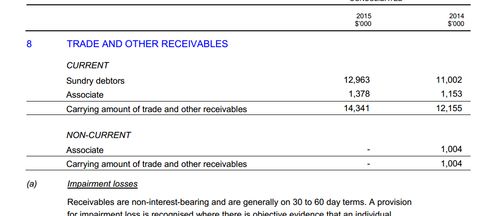

Trade receivables are reported as a current asset on the balance sheet. They are typically listed after cash and cash equivalents and before inventory. The value of trade receivables is determined by the total amount owed to the company by its customers for goods or services provided on credit.

Income Statement

Trade receivables do not directly affect the income statement. However, the collection of trade receivables can impact the cash flow statement. When trade receivables are collected, the cash flow from operating activities increases, which can improve the company’s overall financial performance.

Statement of Cash Flows

The collection of trade receivables is reported as a cash inflow from operating activities on the statement of cash flows. This cash inflow can help a company maintain a healthy cash flow and meet its short-term obligations.

Conclusion

Trade receivables are a critical component of a company’s financial health. By understanding their importance, managing them effectively, and accurately reporting them in the financial statements, a company can maintain a strong financial position and improve its overall performance.

| Aspect | Description |

|---|---|

| Importance | Trade receivables provide liquidity, help manage cash flow, assess credit risk, and evaluate financial performance. |